I came across this article today talking about when good credit doesn't look so good anymore???

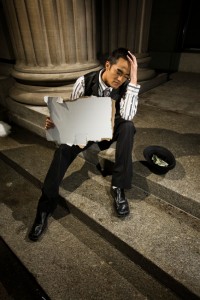

Many people face different circumstances from job loss, pay cut, or over spending can cause financial challenges.

The referenced article gives 3 tips that can help when you reach a financial bump in the road.

These bumps in the road got me to thinking about When Good Credit is in Danger.

"You didn't see your employer headed for financial trouble.

Or you were so busy racking up miles on your travel credit card that you weren't paying attention to how much you were charging, and now the balance is, well, approaching obscene."

Source MSN Money – Good credit in danger? 3 tips

Here are 3 tips to consider when good credit is in danger:

1. Stop using credit cards when good credit is in danger.

When you hit a financial bump in the road you must put away your credit cards.

Many people continue to rely on gas cards or lines of credit when they incur job loss.

You do not want to dig a deeper financial hole for yourself.

Simply because you do not know how long it will take to gain new employment.

2. Make a credit card game plan when good credit is in danger.

Now is the time to see who and how much you owe on all of your credit cards and revolving lines of credit.

You also need to know the interest rates for each of your accounts.

One of the biggest mistakes that people make is to not contact their lender (credit card, mortgage, car loan) when they are going to be late or can not pay your bill.

Simply avoiding the situation only makes things worse.

Some lenders will extend your grace period before charging you a late fee.

Lenders may offer different payment options until you are able to start paying on time or the full amount of the minimum payment.

3. Rethink your finances when good credit is in danger.

You need to first look at ways to cut your monthly bills.

Simple places to look are your cable and cell phone bills.

I also tell my clients to look at budget billing for utilities (gas, electric).

The article also talks about selling items on eBay or holding a garage sale.

Either of these ideas can make you money. Just keep in mind you won't get what you paid for any item.

Next the article talks about turning your hobby into a second job.

For example if you like to cook you can sell dinners on the weekend. It won't interfere with your regular job.

Also mentioned is borrowing money from friends or family. I don't think this is a good idea. If you are unable to pay back the money you can ruin a relationship.

Only go to your church when you are in a real financial hardship. Credit card debt is not something that you should go to your church for help.

There are free credit counselors in your area that can help you get on track.

When good credit is in danger stop all extra curricular activities (movies, date night, football or basketball games) until you look at your overall financial picture.

When good credit is in danger it's time to look at starting a budget to pay all your bills on time.

Are you at a point when your good credit is in danger???

Your financial coach,

Renee Lawson

Recommended Resources:

FREE Video reveals one amazingly simple thing you can do to increase your credit score. Check out the video at www.totalprosperityclub.com.

New Book Coming: www.sexliesandcredit.com.

I'm truly enjoying the design and layout of your website. It's a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Superb work!